Marushika Technology IPO Overview: India’s Emerging Defence & IT Infra SME

Marushika Technology IPO is a book-built SME issue of ₹26.97 Crores It is open for subscription from February 12 to February 16, 2026. The price band is fixed at ₹111–₹117 per share.

Unlike mainboard IPOs, entry barrier is higher in this IPO. Retail investors must apply for a minimum of 2 lots ( i.e., 2,400 shares), this amounts to ₹2,80,800. This Issue is expected to list on the NSE SME platform on February 19, 2026.

The company, based in Delhi, provides IT & telecom infrastructure solutions. Company specialize in data center setup, cybersecurity, surveillance systems and smart technology solutions. It mainly operates on a B2B & B2G model and serves major government and PSU clients like BEL, DMRC and the Indian Air Force. Company has recently entered the Defence Auto-tech segment, providing refurbishment and maintenance service of military vehicles.

This IPO is entirely a Fresh Issue of 23.05 lakh shares and does not include any Offer for Sale (OFS). Company plans to use the proceeds for:

- Repay or pre-pay certain existing loans.

- Meet working capital requirements for ongoing large projects.

- Support general corporate purposes to strengthen their infrastructure and government project pipeline.

Marushika Technology IPO Details: Price Band, Dates, and Lot Size

| Particulars | Marushika Technology IPO Details |

|---|---|

| IPO Open Date | February 12, 2026 |

| IPO Close Date | February 16, 2026 |

| Price Band | ₹111 – ₹117 per share |

| Face Value | ₹10 per share |

| Lot Size | 1200 Shares |

| Minimum Investment | ₹2,80,800 (for 2 lot at upper band) |

| Issue Size | ₹26.97 Crores (approx) |

| Issue Type | Book Built Issue (100% Fresh Issue) |

| Listing On | NSE SME |

Marushika Technology IPO Timeline: Allotment & Listing Date Schedule

| Marushika IPO Event | Important Dates (Tentative) |

|---|---|

| IPO Opening Date | Thursday, February 12, 2026 |

| IPO Closing Date | Monday, February 16, 2026 |

| Basis of Allotment | Tuesday, February 17, 2026 |

| Refunds Initiation | Wednesday, February 18, 2026 |

| Shares Credit to Demat | Wednesday, February 18, 2026 |

| Listing Date | Thursday, February 19, 2026 |

Marushika Technology IPO Issue Structure: Fresh Issue and OFS Breakup

| Issue Component | Marushika Technology IPO Details |

|---|---|

| Total Issue Size | 23,05,200 shares (agg. up to ₹26.97 Cr) |

| Market Maker Portion | 1,16,400 shares (agg. up to ₹1.36 Cr) |

| Fresh Issue (Ex Market Maker) | 21,88,800 shares (agg. up to ₹25.61 Cr) |

| Offer for Sale (OFS) | NIL |

Marushika Technology IPO: Anchor Investor Summary

Marushika Technology Limited successfully raised ₹7.62 Crore from anchor investors on February 11, 2026.

| Anchor Data Point | Details & Key Dates |

|---|---|

| Anchor Bid Date | Wednesday, February 11, 2026 |

| Total Shares Offered | 6,51,600 Shares |

| Total Amount Raised | ₹7.62 Crore |

| 30-Day Lock-in Expiry | Thursday, March 19, 2026 (50% Shares) |

| 90-Day Lock-in Expiry | Monday, May 18, 2026 (Remaining 50%) |

Marushika Technology IPO Reservation: Category-wise Share Allotment

| Investor Category | Shares Offered | Percentage (%) |

|---|---|---|

| Market Maker Shares | 1,16,400 | 5.05% |

| QIB Shares | 10,87,200 | 47.16% |

| − Anchor Investor Shares | 6,51,600 | 28.27% |

| − QIB (Ex. Anchor) Shares | 4,35,600 | 18.90% |

| NII (HNI) Shares | 3,31,200 | 14.37% |

| − BNII > ₹10L | 2,19,600 | 9.53% |

| − SNII < ₹10L | 1,11,600 | 4.84% |

| Retail Shares | 7,70,400 | 33.42% |

| Total Shares | 23,05,200 | 100.00% |

Marushika Technology IPO : Lot Size and Application Amount

| Category | Lots | Shares | Total Amount |

|---|---|---|---|

| Retail (Min)👤 | 2 | 2,400 | ₹2,80,8000 |

| Retail (Max) 👤 | 2 | 2,400 | ₹2,80,800 |

| S-HNI (Min) 💎 | 3 | 3,600 | ₹4,21,200 |

| S-HNI (Max) 💎 | 7 | 8,400 | ₹9,82,800 |

| B-HNI (Min) 🏛️ | 8 | 9,600 | ₹11,23,200 |

Marushika Technology IPO: Company Overview & Business About

Company Overview – Marushika Technology Limited

Marushika Technology Limited is a technology solutions company. It engaged in distribution & implementation of IT and telecom infrastructure products & services. Company mainly helps organizations in setting up and managing their IT infrastructure such as data centres, networking systems, telecom solutions, surveillance systems, cybersecurity & power management. Along with product supply, It also provides installation, maintenance and technical support for smooth & efficient system operations.

Business Verticals

Company operates in various technology-focused verticals::

Read more – company about🏢

- IT & Telecom Infrastructure Solutions – Company offers data centre infrastructure, networking, telecom systems, surveillance and power solutions.

- Smart Solutions – Company provides smart access control, parking, lighting and waste management systems.

- Auto-Tech Solutions for Defence – Company delivers maintenance, refurbishment and reverse engineering of tracked and wheeled military vehicles.

The defence auto-tech segment is a recent addition and started contributing to revenue in FY 2024–25, and additional projects are in progress.

Core Business Model

Company mainly operates on a B2B (Business-to-Business) and B2G (Business-to-Government) model. It works with both private enterprises and government projects, where the end customer is often a government department or PSU. The company generates revenue from two main sources :

- Sale of traded goods (IT hardware, software licenses, and OEM products)

- Sale of services (execution, installation, configuration, and consultancy)

Historically, major portion of revenue comes from traded goods(79.55% in FY25). But in recent years, service segment has gradually increased its contribution(reaching 20.45% in FY25).

Client Base and Project Presence

Marushika Technology Limited provides products and services for infrastructure projects in defence, IT & telecom, transportation, education, and healthcare sectors. Company mainly undertakes projects for central and state government departments and PSUs. Its client includes reputed organizations such as Bharat Electronics Limited (BEL), Central Electronics Limited (CEL), Delhi Metro Rail Corporation (DMRC) and the National Security Guard (NSG).

Execution Track Record & Certifications

The company has consistently increased its execution capabilities and has successfully completed over 150 projects in different infrastructure segments. Company’s ongoing projects were worth around ₹3,545.45 lakh as of December 31, 2025. Marushika Technology Limited is ISO 9001:2015 and ISO/IEC 27001:2022 certified. These certifications reflect its commitment to quality management and information security standards in providing technology & infrastructure solutions.

Marushika Technology IPO: India’s IT Infrastructure & Digital DNA

The Backbone of India’s Digital Economy

The IT industry is a major contributor to India’s economic growth. It contributes 7.5% to the national GDP in FY 2023, which is slightly higher than 7.4% in FY 2022. It also created about 3.2 lakh new jobs during the year. As a result, the total workforce in the sector reached around 5.72 million professionals. IT infrastructure services supports this transformation by building & managing data centers, networks and cloud platforms. This improves internet access across the country, which is essential for connecting citizens, businesses and government bodies through initiatives like “Digital India“.

Read more – Industry 🏭

Market Scale and Growth Potential

India’s IT industry is growing at a fast speed. It is expected to grow at a CAGR of 7.2% and may reach about USD 323 billion by 2027. Strong and secure IT infrastructure helps in adopting transformative technologies like cloud computing, AI and IoT across important sectors like healthcare, education, banking, and agriculture. This transition is also supported by government initiatives. For example, the Union Government has extended the Digital India programme till 2025–26 with an expenditure of ₹14,903 crore to strengthen IT infrastructure & improve cybersecurity.

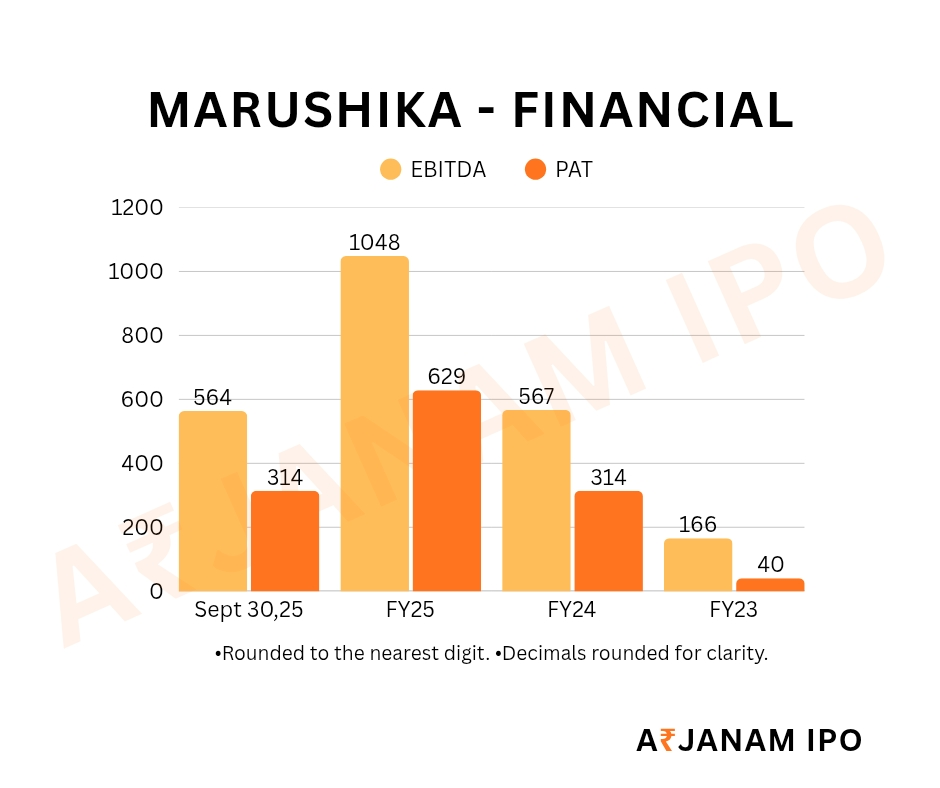

Marushika Technology : Financial Performance Summary

All figures in ₹ Lakh (unless otherwise stated).

| Financial Particulars | H1 FY26 (Sept) | FY 2025 | FY 2024 | FY 2023 |

|---|---|---|---|---|

| Revenue from Operations | 4,863.94 | 8,524.87 | 6,066.23 | 3,698.90 |

| EBITDA | 563.53 | 1,047.26 | 566.89 | 165.80 |

| Profit After Tax (PAT) | 313.83 | 628.64 | 314.11 | 40.25 |

| Total Borrowings | 1,891.50 | 2,137.30 | 1,963.87 | 979.93 |

| Net Worth | 1,851.27 | 1,537.44 | 844.98 | 380.67 |

| Basic & Diluted EPS (₹) | 5.04* | 10.21 | 5.50 | 0.74 |

| NAV per Share (₹) | 29.71 | 24.67 | 97.32 | 48.71 |

Read more – Notes 📑 :

- “Financial data is consolidated and taken from the Red Herring Prospectus (RHP) dated February 2, 2026.

- H1 FY26 figures cover the six months ended September 30, 2025 and are restated and unaudited as per SEBI guidelines.

- EPS for H1 FY26 is for the actual period and is not annualised.

- EPS and NAV are calculated based on pre-issue equity share capital.”

Marushika Technology IPO: Peer Comparison & Valuation Analysis

| Company | Face Value | CMP | EPS | P/E Ratio | RoNW(%) | NAV | PAT(amount in rupees) |

|---|---|---|---|---|---|---|---|

| Marushika TechnologyLimited | 10.00 | ~ | 5.04 | ~ | 18.52% | 29.71 | 313.83 |

| Vertexplus Technolgies Limited | 10.00 | 91.00 | (3.70) | (24.59) | 8.80% | 40.21 | (202.00) |

| Synoptics Technologies Limited | 10.00 | 50.00 | 4.01 | 12.47 | 4.76% | 86.38 | 340.45 |

Read more about peer notes👥

- The listed peer companies are not exactly comparable because the company’s business and size are different, but they are shown for general comparison.

- Marushika numbers are based on its restated consolidated results up to 30 September 2025.

- Peer group figures are based on their consolidated unaudited results up to 30 September 2025.

- CMP (Current Market Price) means closing share price of each company as on 30 January 2026.

Marushika Technology IPO: Objects of the Issue & Use of Proceeds

| Proposed Utilization | Amount (in ₹ Lakh) |

|---|---|

| Repayment and/ or pre-payment, in part or full, of certain borrowings availed by our Company. | 500 |

| Funding the Working Capital requirement | 1,468 |

| General Corporate Purposes | ~ |

Marushika Technology IPO: Key Risk Factors & Concerns

- Dependence on Government and PSU Projects – A significant portion of company’s revenue comes from Government of India and PSU projects, both directly and indirectly through private contractors. PSU clients contributed around 21.05% of revenue in FY25. Changes in policies, budget reductions or any project delays could significantly affect the company performance & cash flows.

Read more – Risk ⚠️

- High Dependence on Top Suppliers – Company obtains a large share of purchases from its top 10 suppliers, contributing about 90.71% in the period ended September 30, 2025 and up to 94.74% in FY2025. Challenges with key suppliers, such as disputes, supply disruptions or unfavorable procurement terms may materially affect operations, costs, profitability and continuity of business.

- High Client Concentration Risk – Company generates a significant share of its revenue from limited number of clients. In FY25, the top five customers generated 64.11% of revenue, while the single largest client contributed 28.35% in H1 FY26. Any loss of a major client may materially affect revenue stability and operations.

- Order Book Realisation Risk – As of December 31, 2025, the order book stood at ₹3,545.45 lakhs.However, contracts may be delayed, modified or cancelled by clients, so the order book may not fully convert into revenue or profit. In case of any contract cancellation or slowdown, cash flows, revenue and profitability may be affected.

- High Dependence on IT & Telecom Infrastructure Vertical – Company generates a substantial share of revenue from the IT & Telecom Infrastructure vertical, which contributed approx. 99.72% of revenue as of September 30, 2025. Despite ongoing efforts to diversify, any drop in demand, technological changes or disruptions in this segment could substantially affect revenue, profitability & operations.

Marushika Technology Limited IPO: Key Competitive Strengths

- Diversified IT Solutions Portfolio – Company provides a wide range of services in IT & Telecom Infrastructure, Smart Solutions & Defence Auto-Tech. Its key products include data centers, surveillance, servers and power solutions for BFSI, railways, defence and healthcare. The IT & Telecom segment generates majority of revenue and forms the backbone of operations.

Read more – Strength 💪

- Strong OEM Partnerships – Company has developed strong relationships with leading OEMs & authorized distributors and works as an authorized reseller of IT and smart solutions. These partnerships, averaging 1–6 years in duration. This helps the company provide competitive pricing, better technical support, advanced cybersecurity solutions and access to latest technology across multiple industries.

- Diversified Industry Presence and Client Relationships – Company works in different sectors like Banking, Insurance, Railways, Defence and Healthcare, this lowers its dependence on any one industry. It has developed long-term relationships with reputed clients, with top 10 customer relationships averaging 1–4 years. This supports stable revenue and repeat business orders in different sectors.

Marushika Technology Limited: Promoter Details & Shareholding Pattern

Company is promoted by three individual promoters who together held 79.71% of the pre-issue equity share capital as per RHP. This indicates strong promoter ownership and long-term commitment to the business.

Promoters

- Monicca Agarwaal – She is the Promoter & Managing Director with more than 26 years of experience in IT infrastructure & BPO. She oversees overall management, business expansion and project sourcing.

Read more – promoter👨💼

- Sonika Aggarwal – She is the Promoter & Executive Director (ED), a Chartered Accountant (CA) with over 22 years of experience in finance, accounting and taxation. She manages financial strategy & controls.

- Jai Prakash Pandey – He is the Promoter & Whole-time Director with over 24 years of experience in telecommunications & IT. He looks after company’s day-to-day operations and execution.

| Promoter | Pre-Issue Holding (%) |

|---|---|

| Monicca Agarwal | 52.89 % |

| Sonika Aggarwal | 4.88 % |

| Jai Prakash Pandey | 21.94 % |

| Total | 79.71% |

Marushika Technology Limited IPO: Dividend Policy & Track Record

Company currently does not have a formal dividend policy and has not declared any dividends in previous financial years. As per Companies Act, dividends can be paid from current or retained profits, this is subject to Board recommendation and approval of shareholders. Any future dividend will depend on factors like profitability, cash flows, capital needs, financing terms and overall financial position. If any dividend declared, it will be paid to shareholders within 30 days from the record date.

Marushika Technology IPO GMP: Live Grey Market Premium Today

| Date | GMP (Grey Market Premium) | Estimated Listing Price | Estimated Gain (%) |

|---|---|---|---|

| Feb 12, 2026 | ₹0 | ₹117 | 0.00 % |

| Feb 13, 2026 | ₹0 | ₹117 | 0.00% |

| Feb 16, 2026 | ₹0 – ₹2* | ₹117 – ₹119 | ~0% – 1.71% |

*While most major trackers reported a Flat (₹0) GMP, some unofficial sources noted a minor movement of ₹2 following the strong 17.94x subscription on the final day.

Marushika Technology IPO : Live Subscription Status

| Category | Day 1 (Feb 12) | Day 2 (Feb 13) | Day 3 (Feb 16) |

|---|---|---|---|

| QIB ( Ex. Anchor) | 0.00 | 0.00 | 2.92 |

| NII | 0.09 | 0.95 | 41.00 |

| Retail | 0.51 | 1.13 | 16.51 |

| Total | 0.28 | 0.77 | 17.94 |

Market Maker portion is not included in the NII/HNI category calculation.

Marushika Technology IPO Allotment Status: Live Link & Results

Marushika Technology IPO allotment is likely to be finalized on February 17, 2026. Once the basis of allotment is confirmed, investors will be able to check their allotment status online through the registrar’s official website i.e., Skyline Financial Services Private Limited.

You can also visit our Arjanam IPO Allotment Status page to access direct registrar links for Marushika and other ongoing SME and Mainboard IPOs. The platform allows investors to easily check their application status using their PAN, Application Number.

Marushika Technology IPO: How to Apply

- UPI Method: Use broker apps like Zerodha, Angel One, or Groww.

- ASBA Method: Apply through your Net Banking portal.

Registrar Contact Details

Skyline Financial Services Private Limited.

D-153 A, 1st Floor, Okhla Industrial Area, Phase – I, New Delhi-110020

Website🌐 – https://www.skylinerta.com/ipo.php

Phone📞 – +91-11-40450193-97

Email – ipo@skylinerta.com

Company Address & Contact Details

Marushika Technology Limited.

Shop No. 5, Acharya Niketan, Mayur Vihar, East Delhi, New Delhi – 110091

Website🌐: https://www.marushika.in

Phone📞: +91 120-4290383

Email✉️ : info@marushika.in

Marushika Technology IPO: Frequently Asked Questions (FAQ) 📂

📊 What is the GMP of Marushika Technology IPO?

As of February 17, 2026, GMP for Marushika Technology is around ₹2. For live grey market updates, visit our ARJANAM IPO – GMP PAGE🚀.

🔍 How can I check Marushika IPO allotment status?

You can check the allotment status once it is finalized (expected on February 17, 2026) through our Arjanam IPO Allotment Status page or directly through the registrar 💻.

🗓️ What is the refund date for Marushika Technology IPO?

The refund/unblocking of funds for non-allottees is likely to start from February 18, 2026 💸.

📈 What is the current subscription status of Marushika IPO?

✅ The IPO was subscribed 17.94 times overall. NII portion was subscribed 41.00x, while Retail investors subscribed 16.51x. For full category-wise details, check our ARJANAM IPO – Subscription Page 🔔.

🗓️ What is the allotment date for Marushika Technology IPO?

The Basis of Allotment is scheduled to be completed on February 17, 2026 📌.

🏦 On which date will IPO shares be credited to Demat accounts?

If you receive an allotment, the shares are expected to be credited to your Demat account by February 18, 2026 💎.

💰 What was the retail lot size and minimum amount?

The minimum application size for retail investors was 1 lot of 1,200 shares, which amounted to ₹1,40,400 at the highest price band of ₹117 💸.

🏷️ What is the price range of Marushika Technology IPO?

The company fixed the price band at ₹111–₹117 per share. 🎯.

⏳ When will the Marushika IPO open and close?

The IPO will available for subscription from February 12, 2026, to February 16, 2026 🔒.

🚀 What is Marushika Technology IPO listing date?

Marushika Technology shares are likely to debut on the stock exchange on February 19, 2026, on the NSE SME (Emerge) segment 📈.

🔍 The IPO information and financial data presented on this page are compiled from the Red Herring Prospectus (RHP), NSE SME filings, SEBI disclosures, and official registrar documents, and are intended strictly for informational and educational purposes only.

HIM KUMAR

Disclaimer ℹ️ : This detailed IPO review is published strictly for educational and informational purposes only and does not constitute investment advice, recommendation, or solicitation to apply, subscribe, buy, or sell any securities. The information is compiled from the Red Herring Prospectus (RHP), DRHP, and other publicly available official sources; however, accuracy, adequacy, or completeness is not guaranteed. Arjanam IPO is not a SEBI-registered investment advisor. Readers should independently verify all data from official filings and consult a qualified financial advisor before making any investment decision, as IPO investments are subject to market risks and personal financial responsibility. Read our full Disclaimer.