Fractal Analytics IPO Overview: India’s First Pure-Play AI IPO Details

Fractal Analytics IPO is a book-built mainboard issue of ₹2,833.90 Crores. It is open for subscription from February 09 to 11, 2026. The price band is set at ₹857–₹900 per share. The minimum retail investment of ₹14,400 (i.e.,1 lot of 16 shares). The IPO is expected to list on February 16, 2026, on both the BSE and NSE.

Company is India’s first pure-play enterprise artificial intelligence (AI) firm. Founded in 2000, It helps global Fortune 500 companies like Google, Microsoft and Nvidia in make more intelligent business decisions using data and AI. Its flagship Cogentiq platform provides “agentic AI” solutions, while its Fractal Alpha division supports specialized AI startups in healthcare (Qure.ai) & marketing (Flyfish).

This IPO includes a Fresh Issue of ₹1,023.50 Crores and an Offer for Sale (OFS) of ₹1,810.40 Crores by early investors like Apax Partners & TPG. The net proceeds from the fresh issue will be used to fund :

- R&D and sales marketing of its AI platforms

- Repayment of borrowings for its US subsidiary

- Setting up new offices in India and buying IT hardware for its global workforce.

Fractal Analytics IPO Details: Price Band, Dates, and Lot Size

| Particulars | Fractal Analytics IPO Details |

|---|---|

| IPO Open Date | February 9, 2026 |

| IPO Close Date | February 11, 2026 |

| Price Band | ₹857 – ₹900 per share |

| Face Value | ₹1 per share |

| Lot Size | 16 Shares |

| Minimum Investment | ₹14,400 (for 1 lot at upper band) |

| Issue Size | ₹2,833.90 Crores (approx) |

| Issue Type | Book Built Issue (Fresh + OFS) |

| Listing On | BSE & NSE (Mainboard) |

Fractal Analytics IPO Timeline: Allotment & Listing Date Schedule

| Fractal IPO Event | Important Dates (Tentative) |

|---|---|

| IPO Opening Date | Monday,February 9, 2026 |

| IPO Closing Date | Wednesday, February 11, 2026 |

| Basis of Allotment | Thursday, February 12, 2026 |

| Refunds Initiation | Friday, February 13, 2026 |

| Shares Credit to Demat | Friday, February 13, 2026 |

| Listing Date | Monday, February 16, 2026 |

Fractal Analytics IPO Issue Structure: Fresh Issue and OFS Breakup

| Issue Component | Fractal Analytics IPO Details |

|---|---|

| Total Issue Size | 3,14,87,777 shares (agg. up to ₹2,834 Cr) |

| Fresh Issue(Ex Market Maker) | 1,13,72,222 shares (agg. up to ₹1,023 Cr) |

| Offer for Sale (OFS) | 2,01,15,555 shares (agg. up to ₹1,810 Cr) |

Fractal Analytics IPO: Anchor Investor Summary

Fractal Analytics raises ₹1,248.25 crore from anchor investors.The anchor bidding, finalized on February 6, 2026.

| Anchor Data Point | Details & Key Dates |

|---|---|

| Anchor Bid Date | Friday, February 6, 2026 |

| Total Shares Offered | 1,38,69,499 Shares |

| Total Amount Raised | ₹1,248.25 Crore |

| 30-Day Lock-in Expiry | Saturday, March 14, 2026 (50% Shares) |

| 90-Day Lock-in Expiry | Wednesday, May 13, 2026 (Remaining 50%) |

Fractal Analytics IPO Reservation: Category-wise Share Allotment

| Investor Category | Shares Offered |

|---|---|

| QIB Shares | 2,30,63,686 (73.25%) |

| − Anchor Investor Shares | 1,38,69,499 (44.05%) |

| − QIB (Ex. Anchor) Shares | 91,94,187 (29.20%) |

| NII (HNI) Shares | 46,12,737 (14.65%) |

| − BNII > ₹10L | 30,75,158 (9.77%) |

| − SNII < ₹10L | 15,37,579 (4.88%) |

| Retail Shares | 30,75,158 (9.77%) |

| Employee Shares | 7,36,196 (2.34%) |

| Total Shares | 3,14,87,777 (100.00%) |

Fractal Analytics IPO Lot Size and Application Amount

| Category | Lots | Shares | Total Amount |

|---|---|---|---|

| Retail (Min)👤 | 1 | 16 | ₹14,400 |

| Retail (Max) 👤 | 13 | 208 | ₹1,87,200 |

| S-HNI (Min) 💎 | 14 | 224 | ₹2,01,600 |

| S-HNI (Max) 💎 | 69 | 1,104 | ₹9,93,600 |

| B-HNI (Min) 🏛️ | 70 | 1,120 | ₹10,08,000 |

Fractal Analytics IPO: Company Overview & Business DNA

What is Fractal Analytics? India’s First Pure-Play AI IPO

Fractal Analytics Limited is an enterprise artificial intelligence (AI) company started in year 2000. For over 25 years, the Company has focused on helping large organizations use data and AI to make better business decisions. Fractal works with global companies in multiple industries and helps them in applying analytics, data science, and AI to practical business problems.

The Company works in data, analytics and AI space and is recognised by independent industry research firms for its enterprise AI capabilities.

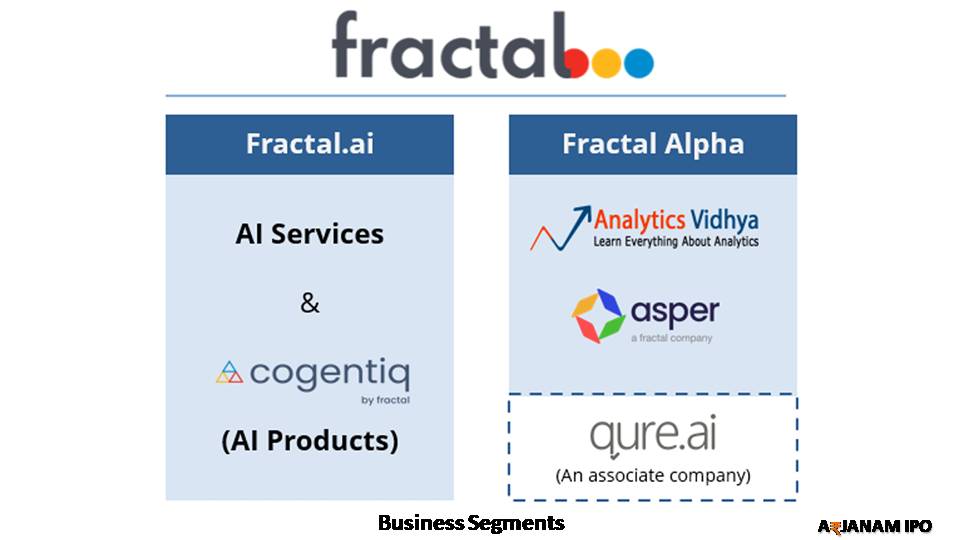

Core Business Segments: Fractal.ai and Fractal Alpha

As of September 30, 2025, Fractal operates in two main business segments:

Read more – company about🏢

- Fractal.ai: This is the main segment and includes AI services and AI products. AI products are mainly delivered through the Company’s Cogentiq platform, which helps enterprises to build, deploy and manage AI applications with proper governance, security, and monitoring features.

- Fractal Alpha: This segment includes independent AI-driven businesses that focus on developing new technologies, platforms, and use cases. These businesses have separate leadership structures to encourage innovation and faster execution.

What Does the Company Do for Clients?

Fractal provides end-to-end / complete AI solutions to businesses. This includes identifying business problems, designing AI-based solutions, building analytical and AI models, deploying them into business systems and supporting business teams in using them. Its services are aimed at improving decision-making in marketing, sales, supply chain, operations, finance, and business strategy.

Company combines data engineering, analytics, machine learning, and design capabilities to help clients integrate AI into daily business work or processes.

Who are the “Must-Win Clients” (MWCs)?

Fractal mainly works with large global enterprises referred to as “Must Win Clients” (MWCs). These are companies that meet set thresholds related to revenue, market capitalisation, or customer scale. As of September 30, 2025, the Company served 122 MWCs.

Its AI solutions are used for customer behaviour analysis, demand forecasting, pricing decisions, marketing effectiveness, supply chain optimisation and executive decision support. All this helps organizations improve efficiency and business results.

Industry Presence: Who Does Fractal Work With?

The Company has experience in consumer packaged goods and retail, technology, media and telecom, healthcare and life sciences and banking, financial services and insurance. As of March 31, 2025, Fractal worked with many leading companies in these sectors, based on their industry revenue rankings.

Fractal AI Innovation: Kalaido, Vaidya, and Project Ramanujan

Fractal invests in research & development in advanced AI technologies. Its innovation initiatives include

- Kalaido.ai, a diffusion-based foundation model that converts text into image

- Vaidya.ai, a multi-modal AI platform designed to support medical reasoning and healthcare decision-making;

- Project Ramanujan, an initiative focused on mathematical reasoning models.

These efforts help Company’s work in generative AI, reasoning systems & agent-based AI for business use cases or applications.

Client Relationships and NPS Scores

Company follows a long-term engagement approach with its clients. As of September 30, 2025, Fractal’s top ten clients had worked with the Company for an average period of over eight years. Client feedback is tracked using Net Promoter Score (NPS), which ranged from 73 to 78 for Fractal.ai segment in recent periods.

People and Culture: A “Great Place to Work

Company focuses on organisational stability and keeping employee engaged. The Company has been certified as a “Great Place to Work” from 2018 to 2025 in multiple regions. Its employee trust index scores have remained above 75 for several years, showing a consistent workplace culture.

Global DAAI Industry: A US$310 Billion Pure-Play AI Opportunity

According to Fractal Analytics RHP and the Everest Report, the global Data, Analytics and AI (DAAI) market is entering a high-growth phase due to widespread adoption of Generative AI.

Read more – Industry 🏭

Market Scale: A US$143 Billion (₹12 Trillion) Global Industry

In FY 2025, the global DAAI market was valued at US$143 billion (₹12 trillion) and is a main driver of enterprise digital spend. The industry is highly concentrated with five main sectors. In FY 2025, BFSI, Healthcare (HLS), Retail, CPG & TMT together made up of 80% of global market share.

Global DAAI Market: US$310 Billion Opportunity by 2030

Growing at 16.7% CAGR, The total addressable market is expected to reach US$310 billion (₹23 trillion) by FY 2030. Gen AI is a major driver, with growth rates in specific industry as follows:

- Healthcare & Life Sciences (HLS): 18.2% CAGR

- BFSI: 16.7% CAGR

- TMT: 15.7% CAGR

- Retail & Distribution: 15.2% CAGR

- Consumer Packaged Goods (CPG): 15.0% CAGR

Mega-Trend: The Rise of Agentic AI

A major change in the industry is the rise of Agentic AI. It creates autonomous systems that can set independent goal and make decision with minimal human intervention. This change or evolution is moving the industry from traditional pattern recognition to independent, context-aware business operations.

The Shift to Third-Party AI Specialists

Companies are increasingly shifting from in-house setups, and spending on third-party digital service expected to grow at 9.4% CAGR through 2030. This change is caused by a severe shortage of niche talent (like ML architects & AI engineers). Companies also need pre-built technology stacks which is provided by third-party specialists like Fractal.

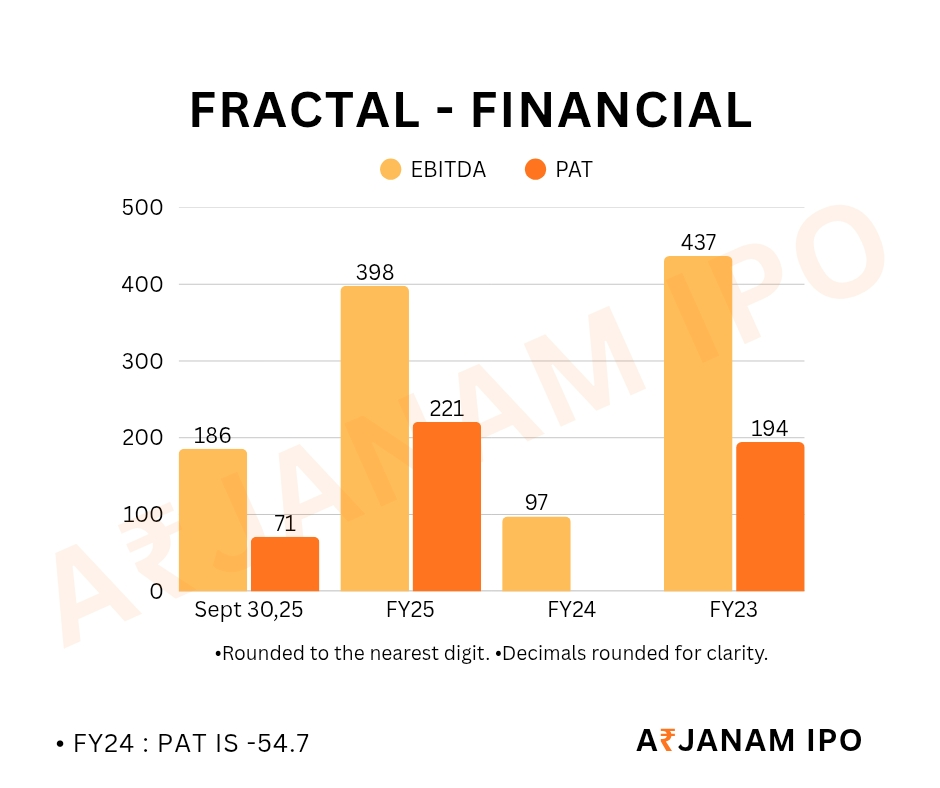

Fractal Analytics: Financial Performance Summary

All figures in ₹ Crore unless otherwise stated.

| Financial Particulars | H1 FY26 (Sept) | FY 2025 | FY 2024 | FY 2023 |

|---|---|---|---|---|

| Revenue from Operations | 1,559.0 | 2,765.4 | 2,196.3 | 1,985.4 |

| EBITDA | 185.6 | 398.0 | 97.2 | 436.8 |

| Profit After Tax (PAT) | 70.9 | 220.6 | (54.7) | 194.4 |

| Total Borrowings | 274.6 | 266.2 | 250.1 | 325.6 |

| Net Worth | 1,957.5 | 1,748.3 | 1,397.0 | 1,339.2 |

| Basic EPS (₹) | 4.55* | 14.49 | (3.12) | 13.39 |

| Diluted EPS (₹) | 4.09* | 13.36 | (3.12) | 12.42 |

| NAV per Share (₹) | 116.0 | 104.0 | 85.0 | 83.0 |

Read more – Notes 📑 :

- “Financial data is consolidated and taken from the Red Herring Prospectus (RHP) dated February 2, 2026.

- H1 FY26 figures cover the six months ended September 30, 2025 and are restated and unaudited as per SEBI guidelines.

- EPS for H1 FY26 is for the actual period and is not annualised.

- EPS and NAV are calculated based on pre-issue equity share capital.”

Fractal Analytics Peer Comparison: A Unique Global AI Player

Fractal Analytics is a global pure-play enterprise data, analytics, and AI (DAAI) company. It has no directly comparable listed peers in India or worldwide. Company covers the full DAAI value chain. It provides advanced analytics, AI services and proprietary software, supported by continuous R&D investment.

Key Differentiators

- Gen AI Leadership: Company has developed four proprietary Gen AI foundation models (like Kalaido.ai and Vaidya.ai). Other industry players have not reported similar capabilities.

Read more – peer section🏢

- Strong IP Portfolio: It reports more DAAI-specific patent filings per employee than most pure-play DAAI service peers.

- Hybrid Business Model: It offers both licensed AI products as well as analytics & AI services. On other hand, peers focus only on services or software.

Objects of the Issue: How Fractal Will Use the ₹1,023.50 Cr Fresh Issue

| Proposed Utilization | Amount (in ₹ million) |

|---|---|

| Investment in one of our Subsidiaries, Fractal USA, for pre-payment and/ or scheduled repayment, in full or in part, of its borrowings | 2,649 |

| Purchase of laptops | 571 |

| Setting-up new office premises in India | 1,211 |

| Investment in (a) research and development; and (b) sales and marketing under Fractal Alpha | 3,551 |

| Funding inorganic growth through unidentified acquisitions and other strategic initiatives, and general corporate purposes | ~ |

Fractal Analytics IPO: Key Risks & Concerns

- Cybersecurity and Data Protection Risk – Cybersecurity attacks, data breaches or system failures at company or its partners can interrupt work & also affect data security. These events can cause financial losses, losing clients, legal liability, higher insurance expense and damage the company reputation.

Read more – Risk ⚠️

- Client Concentration Risk – More than 54% of Fractal.ai segment revenue comes from its top 10 clients, and almost 80% from Must Win Clients (MWCs). So keeping these clients is very important for company success. If company fails to maintain or grow these client relationships, it could decrease revenue, harm cash flows and negatively affect overall business performance.

- Industry Concentration Risk – The company earns 37.5% of Fractal.ai revenue from CPGR, 27.2% from TMT, 17.0% from HLS and 12.2% from BFSI industries. A slowdown, regulations changes or clients adopting AI in-house could lower demand, reduce revenue & harm financial performance.

- Financial related risk – Company had a net loss of ₹547 million in FY 2024, even though its EBITDA was positive at ₹972 million. It also reported losses before exceptional items in FY 2024 and 2023. Ongoing spending on R&D, product innovation and acquisitions could increase costs and affect future profit if revenue growth does not keep pace.

- Litigation and Legal Risk – The Company, its Subsidiaries and two Directors are involved in legal, tax and regulatory cases, including ₹9,158 million in claims against Directors & ₹881 million against the Company. Unfavorable rulings could increase liabilities, raise expenses, and negatively impact business, cash flows & reputation.

- Geographical Concentration Risk – Company makes 64.9% of its revenue from the US, 21% from Europe, and 13% from APAC & other countries around. This exposes company to global operational risks. Any Changes in rules, taxes, currency or political conditions could increase costs and affect revenue & profitability.

- Employee Attrition and Talent Risk -Developing AI, including Gen AI, required skilled people. As of September 30, 2025, company had 5,722 full-time & 149 outsourced staff. Losing talent or higher employee costs could harm growth, productivity and profits.

- Foreign Exchange Risk – More than 90% of company’s revenue comes from foreign currencies, mainly U.S. dollars, pounds and euros. Changing exchange rates or limits on hedging and repatriation could lower profits and negatively affect financial results.

Fractal Analytics IPO: Key Competitive Strengths

- Market Leadership and Global Recognition – Fractal is India’s top pure-play enterprise AI company, serving 92% of its clients worldwide. It recorded 18% revenue CAGR (FY23–25) and provides end-to-end (complete) DAAI services, including Gen AI, computer vision, and NLP. Recognized as a “Leader” by Everest Group and Forrester for several years

Read more – Strength 💪

- Strong and Diversified Client Relationships – The company works with marquee clients across CPGR, TMT, HLS, and BFSI, including Citi, Nestle and Mars. Top 10 clients contributed 54.2% of company revenue and company works with them for an average of 8 years. Net Revenue Retention in the Fractal.ai segment was 114%, showing deep, long-term client relationships.

- Deep and Integrated Technical, Domain and Functional Expertise – Fractal provides complete (end-to-end) AI solutions using its over 25 years of expertise. Its technical strengths include Gen AI, machine vision, cloud and algorithmic decision-making. Domain expertise covers CPG, TMT, and HLS industries, with products like Trial Run and Cogentiq Digital Commerce. Its functional expertise covers sales, supply chain, finance and data teams. Partnerships with Google Cloud, Databricks, OpenAI, and C3 AI enhance company capabilities.

- Track Record of Innovation – Fractal invested ₹1,436 million in R&D in FY25 and has 28 patents. It develops AI products like Cogentiq and Kalaido.ai, while acquisitions and the IndiaAI Mission helps strengthen its capabilities. Its employees also contribute to global AI research.

- Culture of Trust, Transparency and Talent Development – Fractal had 5,722 employees as of September 30, 2025. Fractal uses selective hiring, multiple recruitment channels and employee referrals, this helped in maintaining attrition rate low at 15.7%. Its award-winning learning programs, AI-powered training, and global recognition help keep employees engaged and retained.

Promoters of Fractal Analytics Limited

Company is promoted by its two founding promoters & supported by other promoter group members. As per RHP, promoters and promoter group together held a combined 18.19% of company’s pre-issue equity shares.

Founding Promoters

- Srikanth Velamakanni – He is Co-founder, Vice Chairman nd Group CEO. He has over 25 years of experience in data analytics & artificial intelligence. He leads the Company’s long-term strategy, vision & business growth.

Read more – promoter👨💼

- Pranay Agrawal – He is Co-founder & CEO, with more than 25 years of industry experience. He manages global business operations and key client relationships( mainly in North American market).

Promoter Group

- Chetana Kumar – She leads the Sustainability & manages company’s CSR and ESG (Environmental, Social and Governance) initiatives.

- Narendra Kumar Agrawal – A senior professional with leadership and governance experience who provides strategic guidance to promoter group.

- Rupa Krishnan Agrawal – A business professional with a commerce background. She helps in strategic planning at the promoter-group level.

Fractal Analytics IPO: Dividend Policy & Track Record

Company approved its dividend policy on August 8, 2025. Any dividend declaration will require Board & shareholder approval and must comply with applicable laws. Dividend payment will depend on factors like profits, cash flows, reserves, working capital needs & debt obligations. Company has not paid dividends in recent years and may retain earnings for growth, with no guarantee of future dividends.

Fractal Analytics IPO GMP: Live Grey Market Premium Today

| Date | GMP (Grey Market Premium) | Estimated Listing Price | Estimated Gain (%) |

|---|---|---|---|

| Feb 9, 2026 | ₹21 | ₹921 | ~2.33% |

| Feb 10, 2026 | ₹8 | ₹908 | ~0.89% |

| Feb 11, 2026 | ₹0 | ₹900 | ~0% |

Fractal Analytics IPO: Live Subscription Status

| Category | Day 1 (Feb 9) | Day 2 (Feb 10) | Day 3 (Feb 11) |

|---|---|---|---|

| QIB ( Ex. Anchor) | 0 | 0.03 | 4.41 |

| NII | 0.02 | 0.15 | 1.11 |

| Retail | 0.11 | 0.18 | 1.10 |

| Employees | 0.03 | 0.04 | 0.65 |

| Total | 0.03 | 0.09 | 2.81 |

Note: Figures may slightly differ from official exchange reports due to anchor inclusion and bid scrubbing by the registrar.

Fractal Analytics IPO Allotment Status: Check Direct Link & Results

The Fractal Analytics IPO allotment is expected to be finalized on February 12, 2026. Investors can check their allotment status online on the official registrar website, MUFG Intime India Private Limited (early Link Intime).The link will be available once it is activated.

You can also use our IPO Allotment Status page to find direct registrar link for Fractal and other active Mainboard & SME IPOs. It helps you easily check your application status using your PAN or Application Number.

Fractal Analytics IPO: How to Apply

- UPI Method: Use broker apps like Zerodha, Angel One, or Groww.

- ASBA Method: Apply through your Net Banking portal.

Registrar Contact Details

MUFG Intime India Pvt.Ltd.

Link Intime India Private LtdC 101, 247 Park, L.B.S.Marg,Vikhroli (West), Mumbai – 400083

Website🌐 – https://in.mpms.mufg.com/Initial_Offer/public-issues.html

Phone📞 – +91-22-4918 6270

Email – fractal.ipo@in.mpms.mufg.com

Company Address & Contact Details

Fractal Analytics Ltd.

Level 7, Commerz II,International Business Park, Oberoi Garden CityOff W. E. Highway, Goregaon (E),Mumbai, – 400063

Website🌐: https://fractal.ai/

Phone📞: +91 22 6850 5800

Email✉️ : investorrelations@fractal.ai

Fractal Analytics IPO: Frequently Asked Questions (FAQ) 📂

📊 What is GMP of the Fractal Analytics IPO?

As of February 12, 2026, GMP of Fractal Analytics is approximately ₹0 to ₹2. For live GMP updates, you can visit — “ ARJANAM IPO – GMP PAGE”🚀.

📈 What is current subscription status of Fractal IPO?

✅On day 3 (Final Day), IPO was subscribed 2.66 times in total.The Retail portion finished at 1.03x, while the QIB portion led at 4.18x. For hourly updates, check “ARJANAM IPO – Subscription page 🔔.

🔍 How to check Fractal Analytics IPO allotment status?

You can check allotment status on our dedicated “Arjanam Ipo – Allotment Status” page or on the official registrar’s website 💻.

🚀 What is the expected listing date of Fractal Analytics?

Fractal Analytics shares are likely to list on the exchanges on Monday, February 16, 2026📈.

🗓️ When will Fractal Analytics IPO refund start?

In case of non allotment, refunds will start on February 13, 2026💸.

💰 What is minimum investment required for retail investors?

Retail investors must apply for a minimum of 1 lot (16 shares). At the upper price band, total amounts of investment is ₹14,400 💸.

🗓️ What is allotment date for Fractal Analytics IPO?

The Basis of Allotment (BOA) is expected to be finalized on Thursday, February 12, 2026 📌.

⏳ What are the opening & closing dates of the Fractal IPO?

Issue will open for subscription on February 9, 2026 and will close on February 11, 2026🔒.

🏦 When will shares be credited to the Demat account?

For successful applicants, shares are expected to be credited in Demat accounts by Friday, February 13, 2026💎.

🏷️ What is the price band of the Fractal Analytics issue?

The price band has been fixed at ₹857 to ₹900 per equity share🎯.

🔍 The IPO information and financial data presented on this page are compiled from the Red Herring Prospectus (RHP), stock exchange filings (NSE & BSE), SEBI disclosures, and official registrar documents, and are intended strictly for informational and educational purposes only.

HIM KUMAR

Disclaimer ℹ️ : This detailed IPO review is published strictly for educational and informational purposes only and does not constitute investment advice, recommendation, or solicitation to apply, subscribe, buy, or sell any securities. The information is compiled from the Red Herring Prospectus (RHP), DRHP, and other publicly available official sources; however, accuracy, adequacy, or completeness is not guaranteed. Arjanam IPO is not a SEBI-registered investment advisor. Readers should independently verify all data from official filings and consult a qualified financial advisor before making any investment decision, as IPO investments are subject to market risks and personal financial responsibility. Read our full Disclaimer.